A bank can produce, with its discretion, a minumum of one Homeownership Put-Out Applications pursuant for the conditions of the part

( d ) In which AHP lead subsidy is being always purchase down the rate of interest out-of financing or finance out of a part or most other class, the borrowed funds pond recruit will use the complete level of the fresh AHP head subsidy to order down the interest rate on a beneficial permanent basis during closure on the such as loan or loans.

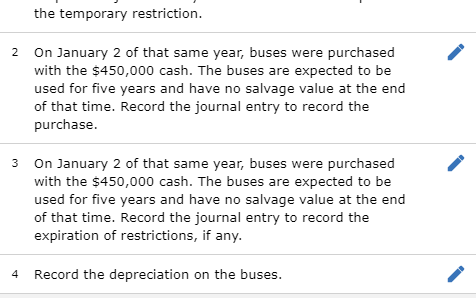

Eligible people.

A financial should accept software having AHP head subsidy less than its Homeownership Place-Aside Software merely off institutions that will be people in the bank at the time the application form is actually published to the financial institution.

Qualification requirements.

An effective Bank’s Homeownership Put-Aside Software shall meet the eligibility requirements set forth inside part. A bank will most likely not follow even more eligibility conditions because of its Homeownership Set-Away Software with the exception of eligible domiciles pursuant so you can paragraph (b) of area.

( a good ) Member allocation criteria. AHP head subsidies might be offered to players pursuant to allowance requirements founded by the Financial in AHP Implementation Plan.

( step one ) Keeps revenue from the or less than 80 percent of one’s average earnings into the area at that time your family try approved for registration because of the member on Bank’s Homeownership Lay-Aside Software, which have like duration of enrollment because of the user defined by Financial in its AHP Execution Bundle;

( 2 ) Done a homebuyer otherwise homeowner guidance program provided by, otherwise considering one available with, an organization proficient in homebuyer or citizen counseling, in the example of properties that are first-date homebuyers; and

( step 3 ) Are basic-big date homebuyers otherwise property acquiring AHP subsidy for owner-occupied rehabilitation, when it comes to property choosing subsidy pursuant on you to definitely-third lay-aside resource allocation requirement from inside the (b), and fulfill like most other qualifications criteria which is often depending of the the lending company within the AHP Implementation Plan, such as for instance a corresponding loans requisite, homebuyer or homeowner guidance requirement for home which aren’t very first-time homebuyers, or requirements that provides priority on the pick otherwise rehabilitation out of loans in Sylvan Springs homes in particular components otherwise as part of an emergency recovery effort.

( c ) Limit give limitation. Users will give AHP lead subsidies so you can households because a grant, in a cost to a maximum established because of the Financial, to not ever go beyond $22,100 for every family, hence restriction shall to evolve upward towards a yearly foundation in keeping with expands when you look at the FHFA’s Home Price List (HPI). In the event of a decrease in the brand new HPI, new subsidy restriction should stay at the upcoming-latest count before the HPI grows over the subsidy limit, of which point the brand new subsidy maximum shall conform to that higher amount. FHFA tend to notify the banks a year of the maximum subsidy limit, according to the HPI. A financial can produce a separate restriction give restrict, to the utmost give restriction, for each and every Homeownership Put-Aside Program they establishes. A Bank’s limit grant maximum for each and every like program might be utilized in its AHP Execution Package, and this limitation will apply at all of the houses throughout the certain system by which its dependent.

( d ) Eligible spends off AHP lead subsidy. Households should use the AHP lead subsidies to pay for down fee, closure rates, counseling, otherwise rehabilitation recommendations concerning the the newest household’s purchase otherwise treatment out of an owner-occupied tool, along with good condo otherwise cooperative property device otherwise are manufactured housing, for usage because household’s no. 1 residence.

( e ) Maintenance agreement. A holder-filled product ordered, or bought in combination that have rehab, playing with AHP head subsidy, are going to be at the mercy of an excellent four-seasons storage contract discussed when you look at the (a)(7).