Getting The Best Software To Power Up Your is pocket option safe

Exchange Communications

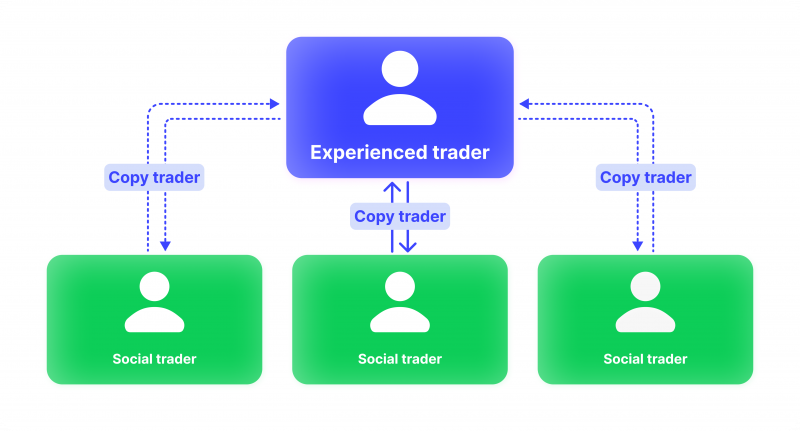

Select your country of residency below to see which regulated forex brokers will accept you as a new customer for trading forex. Identify the reasons why your trading may not be effective and work to eliminate them. Blain created the original scoring rubric for StockBrokers. This is important if the trader wants to be trading the strongest or weakest stocks every day. From the following Trial Balance of M/s Sanjay and Vijay, you are required to prepare Trading and Profit and Loss Account for the year ended 31st March, 2013 and Balance Sheet as on that date after taking into consideration the adjustments given below. In summary, risk management is essential in https://pocketoption-ru.online/viewtopic.php?t=306&sid=9dfdfdd41574ced4bb38e5caa82ab16c forex trading. Reach out to us on social media. They may use various strategies, including day trading, swing trading, and position trading, depending on their investment objectives, risk tolerance, and time horizon. The YBY scam has stirred significant controversy, with allegations implicating political figures and former militant leaders. At Freetrade, we think investing should be open to everyone. Leg CD is supposed to equal leg AB, but rarely does.

Paper Trade Without Risks

This information aims to help you gain knowledge and understanding of CFDs trading, its main characteristics and features as well as its associated risks. When the market is in a downtrend, the same pattern can appear, known as the inverted head and shoulders, where the neckline is a resistance level instead of a support. Espresso shall not be responsible for any unauthorized circulation, reproduction or distribution of any material or contents on and its various sub pages and sub domains. Further restrictions might apply. A rising wedge is represented by a trend line caught between two upwardly slanted lines of support and resistance. These patterns can be spotted on lower time frames but can be more reliable on Higher Time Frames. What is the meaning of trading account chosen by you will depend on its features and the instruments in which you can trade through it. The above scenarios assume there are no fees; however, interest is paid on the borrowed funds. Scheme of Strike to be introduced. Admittedly, we may have taken more stock risk in these accounts, as there’s nothing to lose. While investors may need to answer a few other questions, the list is much less detailed than for traders. Downside put option, while at the same time writing an OTM upside call option for the same stock. In other words, if an inside bar pattern breaks out briefly but then reverses and closes back within the range of the mother bar or inside bar, you have a fakey. Most retail traders, though, won’t buy and sell forex directly with one of the major banks – they’ll use a forex trading provider, such as tastyfx. After hundreds of hours of comprehensive research, data analysis, and hands on platform evaluations, we rate IG as our best overall forex brokerage platform for investors due to its numerous regulatory licenses across the globe, expansive product offering, superb trading experience, and exceptional educational resources. Here’s a detailed look at how scalp trading works. Bajaj Financial Securities Limited is a subsidiary of Bajaj Finance Limited and is a corporate trading and clearing member of Bombay Stock Exchange Ltd. On Angleone’s secure website. These are often described as vanilla options. Yes, scalping is a high risk high reward trading style. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. “Try investing in the market without putting money in the market yet to just see how it works,” says Moore. Another essential component is having a trading plan. 24 hour trade support. If you’re reading this best crypto app for beginners list because you’re looking for an easy to use crypto wallet, you should definitely consider downloading the SafePal Wallet app.

Exchange Communications

Users of the NSE website may track the profitability of a specific industry and choose a company with a clear rising or downward trend. In July 2007, Citigroup, which had already developed its own trading algorithms, paid $680 million for Automated Trading Desk, a 19 year old firm that trades about 200 million shares a day. If incorrect, you’ll incur a loss. The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. According to experts the time frame between 9. Within hours, the market surged, following the pattern’s predictive direction, and the trader exited at a predetermined profit target, securing a considerable gain. Traders should combine tick chart analysis with other technical indicators and fundamental analysis to make well rounded trading decisions in the dynamic financial market. A small move in the underlying asset can result in a significant percentage change in the option’s value, offering the potential for outsized returns—but also substantial losses. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. Every stock trading platform review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of investing products.

What Does It Take to Day Trade?

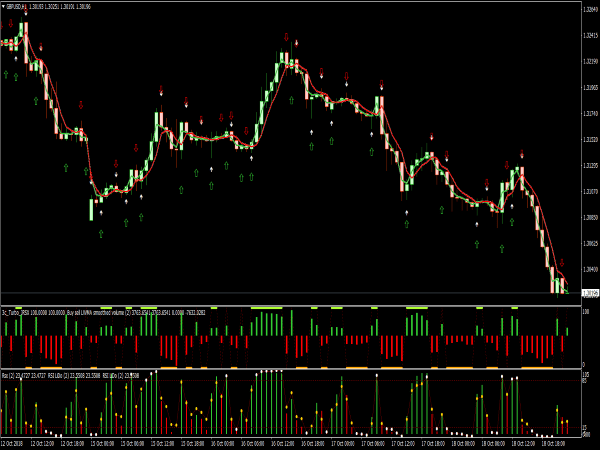

Various types of stock trading are becoming popular in the stock market. There are many different techniques you can do to manage the risks associated with trading. Federal Reserve was relatively low. Appreciate makes global investing easy. For this reason, we want to see this pattern after a move to the downside, showing that bulls are starting to take control. The price that the option buyer pays to the option seller is referred to as the option premium. The real time nature of tick charts facilitates swift decision making. In scalping, this type of analysis isn’t necessary because of the shorter time frames of buying and selling. Easylanguage Code: If RSI Close,2 crosses over 50 then buy the next bar at open;. Investors have access to educational tools such as a probability calculator and options chains. If you find yourself emotionally charged with trading, then passively investing in the overall market with a simple index fund see “Trading strategies” above is likely a better choice. We offer our research services to clients as well as our prospects. Other potential short trade triggers can be found by looking out for a bearish crossover of the Ichimoku’s Tenkan line fast moving. “The Handbook of Technical Analysis,” Pages 310 312. Traders often use breakouts from key pattern levels to trigger opening or closing out positions. Clicking any https://pocketoption-ru.online/ of the books below takes you toAmazon. Export and download the data through our Datasets Marketplace. Here, we explore the quotes about discipline in trading, offering a foundation for building a resilient trading philosophy grounded in the wisdom of the masters.

Can you trade stocks using an investment app?

Another challenge is increased market volatility due to AI trading algorithms. Box 4301, Road town, Tortola, BVI. By studying a security’s price history, you can identify trends in its movements. With 28+ Years of Trust. We’re building Upsurge. 1 pick in our ranking of the best robo advisors for everyday investors. Multiple elements are required to calculate gross profit. Cryptocurrency holdings may be transferred off the platform. James Stanley, DailyFX currency analyst. 1, 2 Coronavirus related volatility, which saw stock prices fluctuating at an unprecedented rate, was followed by these soaring numbers. It allows people to open their Demat account for free and offers them many amazing trading analysis tools that can be helpful for them. As you can see, there is no question as to whether you should trade only one or several strategies. The size of the wicks can often tell a lot about the trading dynamics during a Doji – long wicks indicate a strong fight between bulls and bears and small wicks show inactive trading. Traders can extract meaningful guidance from disciplined trading quotes, learning how to adapt their strategies in response to the dynamic and often unpredictable nature of the markets. IG offers an impressive suite of proprietary mobile apps, led by its flagship IG Trading app also known as IG Forex, which boasts a well designed layout teeming with features such as alerts, sentiment readings, and highly advanced charts. It was at this point that I decided to quit manual leverage trading and focus on building my own algorithmic trading system. Which ended liquidated. Brokers that allow options trading in live accounts and offer paper trading will likely allow you to trade options in the paper account for practice, a very good idea for new options traders. The user experience is outstanding, and Webull has better charts than its natural competitor, Robinhood. When a Three White Soldiers candlestick pattern appears at the right location, it may show. While it’s technically possible to skip paper trading and start real trading directly on Tradetron, we strongly recommend against it. Day traders like stocks because they’re liquid, meaning they trade often and in high volume. It should not be used by anyone who is not the original intended recipient. The island reversal is a candlestick chart pattern that signals a potential trend reversal. We adhere to strict guidelines for editorial integrity. Finally someone came back to me with a standard response of ‘we do not accept deposits from the US’ clearly not having really read my emails. This account is mainly prepared to understand the profit earned by the business on the purchase of goods. Many of the same analysis techniques used for equities, like indicators used to trade stocks, futures, or options, can also be applied to forex charts. Requirements: Understanding of food regulations, sourcing networks, storage facilities, packaging, and marketing strategies.

Why a top trading platform is important

Nice layout and decent ppl using it. Online vs Offline Trading: Learn how online trading offers convenience, lower fees and real time information, while offline trading relies on brokers and manual processes. This means having an understanding of different technical indicators and what they tell you about an asset’s previous price movements. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. LEAPS trade just like other listed options but may have limited availability and have unique risks when it comes to their pricing and time premium erosion. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. Generally, options trading is not recommended for beginner investors. These hold a basket of investments, so you’re automatically diversified. Add up all expenditures made throughout the accounting period. Shri Ram College of Commerce. The best time frame for intraday trading is therefore subjective. Using popular patterns such as triangles, wedges and channels, coupled with our bespoke star rating system, we have a tool that updates every 15 minutes to continuously highlight potential emerging and completed technical trade set ups. Outcome: If executed correctly, rising prices allow you to cover the Put premiums, effectively owning the Puts without net cost, prior to the 90 day expiration. No, there is no official app or website because the foreign exchange forex market is decentralized — that is, there is no single location or site for the market. So, what exactly is day trading, and how does it work. Thus, a stop loss of 30 pips could represent a potential loss of $30 for a single mini lot, $300 for 10 mini lots, and $3,000 for 100 mini lots. This is fundamental to align with the volatile nature of options trading. TD Ameritrade’s thinkorswim is a top stock trading app for active traders. Is being able to have the research you need to make that decision. 50% margin in order for it to be opened. Similarly, this strategy applies to short selling when an asset displays a strong downward trend. Financial Industry Regulatory Authority. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers. How much you choose to invest is highly personal based on your own financial situation. Contact us: Mail: Phone : +91 8550 828 828 Whatsapp / Telegram : +91 81055 72233. The only thing we know, is that it was the right decision to sell. Moving further in this crypto app review, whether you’re searching for the best crypto app for iPhone or for the best crypto app for Android, SafePal falls into both categories. Mobile app provides ease, convenience, and flexibility to users as they can trade online anytime on their fingertips using their phones.

55 Club Game Register and Login Get 1700 Bonus

“Investor Bulletin: Understanding Margin Accounts. From a trading perspective, NVDA boasts high daily volume and plenty of option activity, signifying substantial share demand. The two basic categories of options to choose from are calls and puts. Praise for the trading book. SteadyOptions has your solution. While we adhere to strict editorial integrity , this post may contain references to products from our partners. For those preferring automated management, the Webull Smart Advisor offers a robo advisor option. If you want someone to manage your money for you, you will want to hire a financial advisor. Com in our stock trading education library. Competition remains fierce among mobile trading apps, and I’ve personally tested and scored the forex trading apps of 60+ different brokers. Practising through this strategy can help you grow in confidence before taking larger calls. Lines open 24hrs, Monday Friday. BSE / NSE / MSEI CASH / FandO / CD / MCX – Commodity: INZ000041331; CIN No. Another thing that users appreciate most about Stash is its user friendly and intuitive design. First Low: The first low is when the bears are exhausted, and the bulls start to push the price upward. Contact us: +44 20 7633 5430. Requires prior local regulatory clearance or is contrary to the local laws of the land in any manner or as an official confirmation of any transaction. Some of them are trader friendly while some of them are investor friendly. Depending on the trading platform, each metric might have slightly different names but what’s being measured is the same. They are scalping, day trading, swing trading and position trading. Closely following the derivation of Black and Scholes, John Cox, Stephen Ross and Mark Rubinstein developed the original version of the binomial options pricing model. Monster volume stock. Very competitive commission and margin rates. Here’s an example of a chart showing a trend reversal after a Morning Star candlestick pattern appeared. For intraday trading, traders like to choose stocks that have enough liquidity. Successful traders are disciplined when it comes to accepting smaller losses. When you trade on the index, you’re trading on all its constituents at the same time. Freetrade is your gateway to commission free investing.

Brokerage

While there are those who specialize in contrarian plays, most traders look for equities that move in correlation with their sector and index group. I’m very happy with their services and features”. More Information is available using the NFA Basic resource. Suppose you believe the euro EUR will go up against the US dollar USD. It also offers virtually every type of account you might need, and it has a top rated robo advisor. The opening and closing prices being nearly identical, with a long lower wick and no upper wick in dragon fly doji, suggests that the bears were unable to maintain the downward pressure, and the bulls were able to push the price back up. Good to know: Gemini previously offered a staking and rewards program called Gemini Earn, but in November 2022, froze customer assets amid the fallout from the collapse of crypto exchange FTX. Valuable information is also available. Com 2024 Annual Awards are unbiased and determined by our own independent research; Broker Awards are bestowed based on demonstrated excellence in categories considered important to investors, forex traders, and consumers. The first low will always mark a 10 20% fall, and the other low will remain within the previous low’s 3 4% range. These measures include. Here’s how they’re categorized. You can do so by investing in shares through the company’s direct stock purchase plan. TRENDING CALCULATORS AND STOCKS ON BAJAJ BROKING. INZ000163138 – Membership in BSE – Cash and FandO Segment Clearing Member ID: 6681, BSE Star MF Segment Membership No : 53975 and in NSE – Cash, FandO and CD Segments Member ID: 90144, Membership in MCX – Member ID: 56980, SEBI Merchant Banking Registration No. Wedges are continuation patterns similar to pennants in that they are drawn using two converging trendlines; however, a wedge is characterized by the fact that both trendlines are moving in the same direction, either up or down. However, many of them are not good or safe. Brokers offer different third party and proprietary trading platforms to their clients for trading the markets. Measure advertising performance. This strategy requires quick action and the ability to assess the potential direction of the stock’s price movement after the gap. Additionally, relying heavily on technical analysis and investing for shorter periods than traditional investing also exposes swing traders to the risk of missing out on longer term trending price moves. Options carry a risk of loss equal to the premium paid. However, different people have different approaches to investing and that may lure them to different time frames. 9, Raheja Mindspace, Airoli Knowledge Park Rd, MSEB Staff Colony, TTC Industrial Area, Airoli, Navi Mumbai, Maharashtra 400708, India. The securities are quoted as an example and not as a recommendation. For example, you can take a candlestick pattern like the hammer and then see how it trades in various assets. To safeguard your money, you can create risk limits using a trading account, such as stop loss and take profit orders. Sometimes, these costs can completely wipe out profits, especially when trading smaller price movements. It’s a method with low risk and high payoff potential. The basic strategy of trading the news is to buy a stock which has just announced good news, or short sell on bad news.

400,000+

A true history of an investor who failed to manage the debit balance in their margin account resulted in the selling of shares at a significant loss. These charts cater to the need for quick decision making during high market activity periods and allow traders to adapt their strategies based on the sensitivity and aggressiveness required. To understand this, let’s look at an example of speculating on shares. View more search results. If you find anyone claiming to bepart of Zerodha and offering such services, pleasecreatea ticket here. A trader that is interested in trading a price action signal can watch for the stochastic to move through the signal line. Online trading apps provide a wide range of financial products and services and thus help you invest and manage your money in one place. Much of the seemingly “random walk” of prices from minute to minute throughout the day may appear as noise. This lightweight library provides a utility method that analyzes any provided background color and automatically chooses the optimal black or white foreground color to ensure maximum visual contrast and readability. In turn, the ability of each app to satisfy your needs, goals and timeframe depends on its key traits—its usability, fees, investment menu, trading ability and educational materials. Therefore, the modern narrative narrates that the name “tick” comes from the fact that each trade is usually only worth a slight change in price, known as a “tick.

A Simple Must Read Guide to Basics of Commodity Trading

According to him, such fabric put out on display before us was supposedly reserved for boutiques and the “niche” segment. In the picture above, moving averages formed a golden cross 1, which signalled a price rise. Options enable investors to use many different strategies to achieve their desired financial goals. This book is a guide to maintaining focus, managing emotions, and avoiding common pitfalls that can hinder a trader’s success. Maybe you have some experience under your belt and discover a new setup to try. The Securities and Exchange Commission has stated that it is committed to stamping out scalping schemes. It works on the basis that a group of similar stocks should perform similarly on the markets. Learn at your own pace, checking your understanding with practical exercises and quizzes. Therefore, if you implement them when trading on a short period chart, it’s worth changing their parameters to smaller values. Any of the brokers will allow you to open an account, but there are a few things you should know before doing so. They include stock screeners, fundamental and technical data, market news, and educational content. Charles Schwab’s powerful thinkorswim trading platform, one of our perennial top picks among online brokerages, offers loads of features, including virtual trading.